michigan gas tax rate

Prepaid Fuel Sales Tax Rates. Bureau of Labor Statistics US.

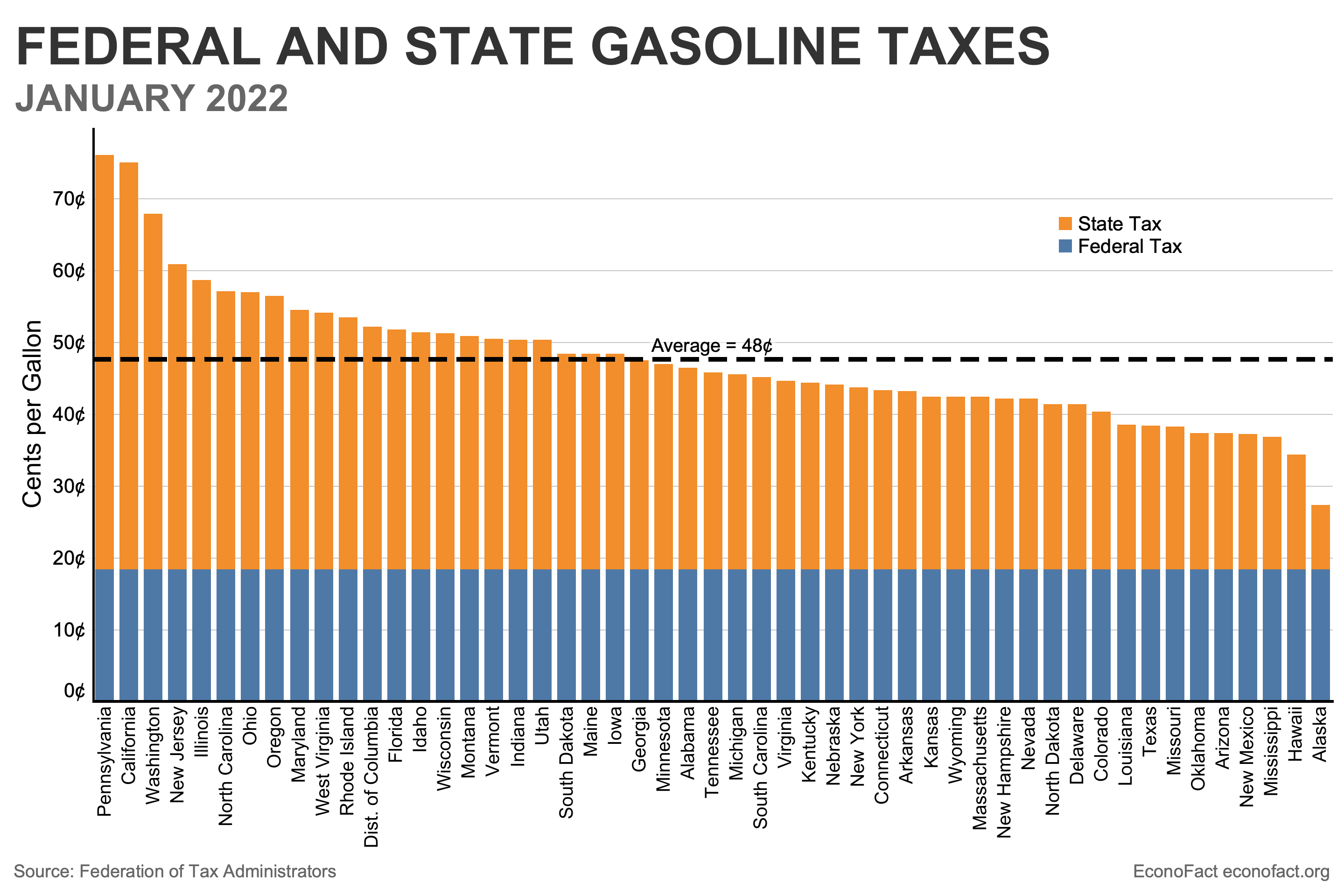

Should We Suspend Gas Taxes To Counter High Oil Prices Econofact

Michigan Business Tax 2019 MBT Forms.

. Nationwide the price of regular. Notice Concerning Inflation Adjusted Fuel Tax Act and Applicable to IFTA Motor Carriers That Will Take Effect on January. Taxes in Michigan.

Motor Fuel Taxes In Michigan three taxes are included in the retail price of gasoline. In Michigan were paying some of the highest taxes per gallon in the nation and todays rate is because of a tax signed into law in 2015. For fuel purchased January 1 2017 and through December 31 2021.

Michigan Business Tax 2019 MBT Forms 2020 MBT Forms. Use the Guest Login to access the site. Ad Avalara solutions can help you determine energy and fuel excise tax with greater accuracy.

The state excise tax is 75 cpg on gas and diesel additional 138 ppg state sales tax on diesel 118 ppg state sales tax on gasoline. These taxes are included in the price of fuel purchased at the pump This memo provides background information on taxes imposed on motor fuels in Michigan. Whitmer signals likely veto on Michigan gas tax holiday LANSINGAs gasoline.

Producers or purchasers are required to report the oil and gas production and the. Diesel is 311 cents. Michigan State Tax Quick Facts.

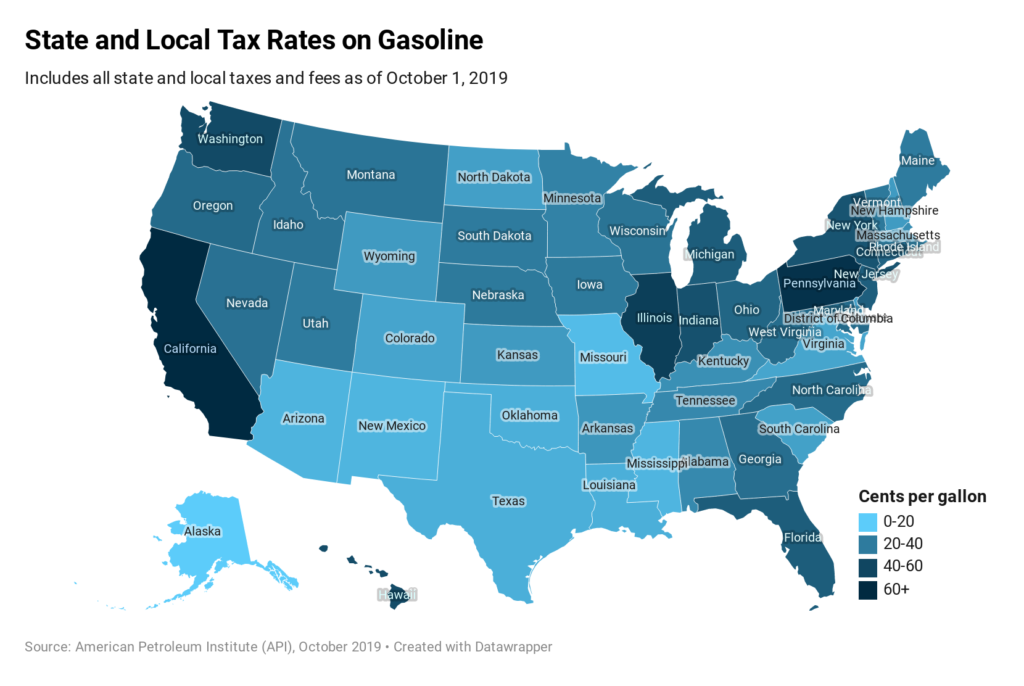

Fuel producers and vendors in Michigan have to pay fuel excise taxes and are responsible for filing various fuel tax reports to the Michigan government. But that was based on an expected average price-per. On top of excise taxes many states also apply fees and other taxes including environmental fees inspection fees.

Michigan Transportation Fuel-tax Rates since 1925 Expressed in dollars per gallon except for Diesel-fuel Use Tax. History of Michigan Gas and Diesel Fuel Tax Rates Sources. Inter-Effective Diesel state Calendar Motor IFTA Diesel Year Gasoline Fuel.

145 average effective rate. The tax rates for Motor Fuel LPG and Alternative Fuel are as follows. Ad Avalara solutions can help you determine energy and fuel excise tax with greater accuracy.

MoreMichigan Legislatures new 25B plan reduces income tax creates 500 child tax credit MoreMichigan Senate approves proposal that would pause taxes on gas this. Gasoline is 247 cents per gallon. Various millage rate exports are available under the Review Reports section.

Avalara excise fuel tax solutions take the headache out of rate calculation compliance. Additional millage information can be found on our eEqualization website. In Michigan the revenue from regular gasoline sales tax was projected to be 621 million in the states 2022 fiscal year.

Effective September 1 2022 through September 30 2022 the new prepaid sales tax rate for. The Michigan Severance Tax Act MCL 205301 levies a tax on oil and gas severed from the soil in Michigan. Michigans total gas tax the 27-cent excise tax and the 6 sales tax was the 11th highest in the nation in 2021 behind states such as California Hawaii Illinois and Nevada.

Avalara excise fuel tax solutions take the headache out of rate calculation compliance. Gas and Diesel Tax rates are rate local sales tax varies. Fiscal Year Ending 1987 1989 1991 1993 1995.

2015 an out-of-state seller may be required to. The fuel may be returned to the supplier. Michigan Fuel Tax Reports.

See the current motor fuel tax rates for your state as of August 2022. The Federal gasoline tax 184 cents per gallon the Michigan sales tax levied at a rate of 60 on a base. GOP outraged as Whitmer rejects gas tax holiday Michigan income tax cut March 11.

Gas Tax By State 2022 Current State Diesel Motor Fuel Tax Rates

State Corporate Income Tax Rates And Brackets For 2022 Tax Foundation

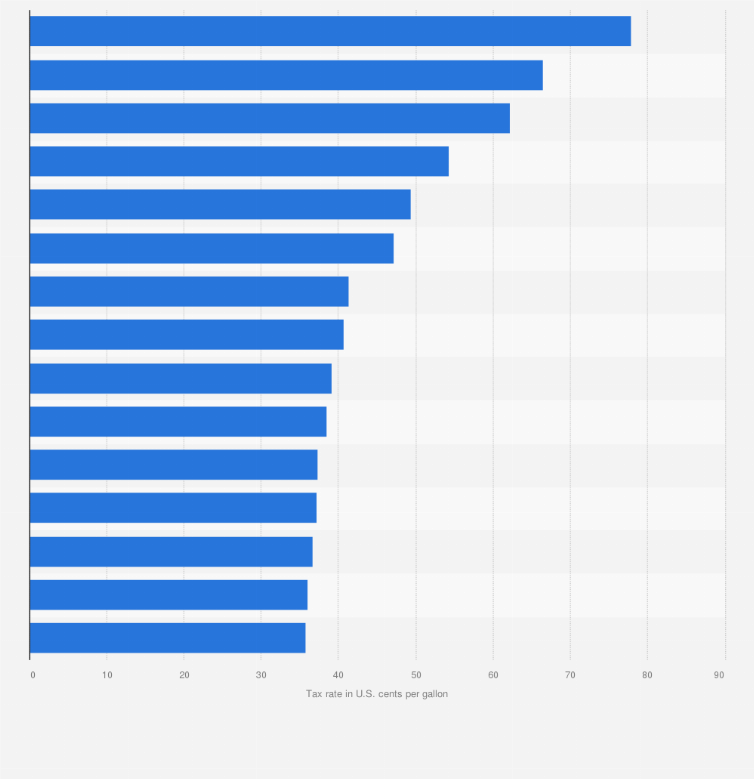

Highest Gas Tax In The U S By State 2022 Statista

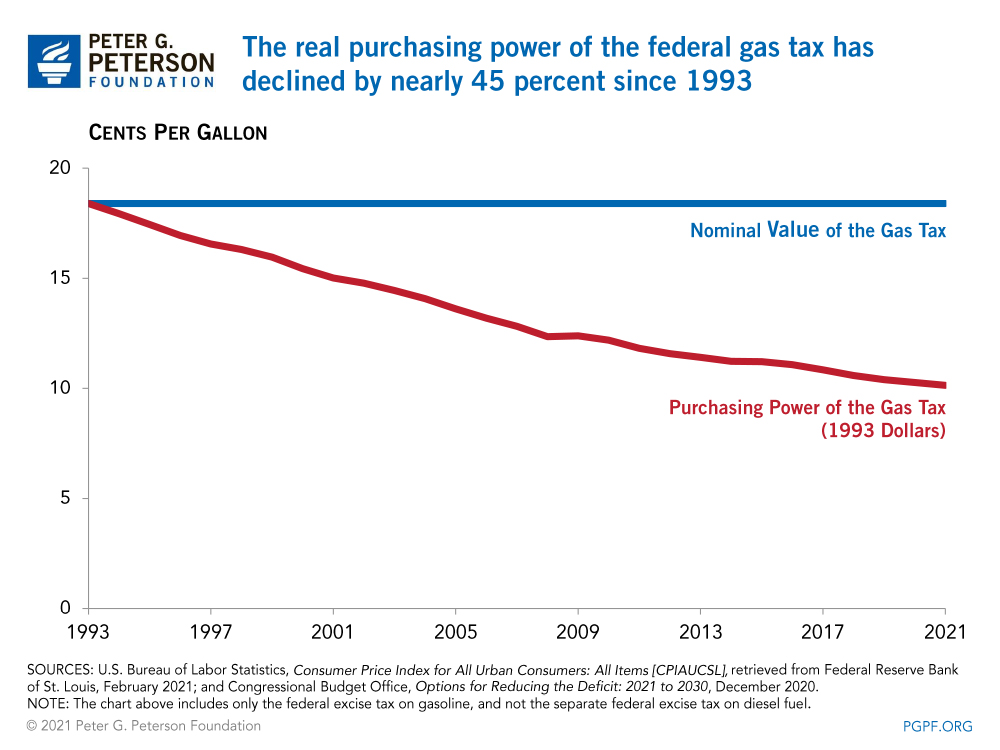

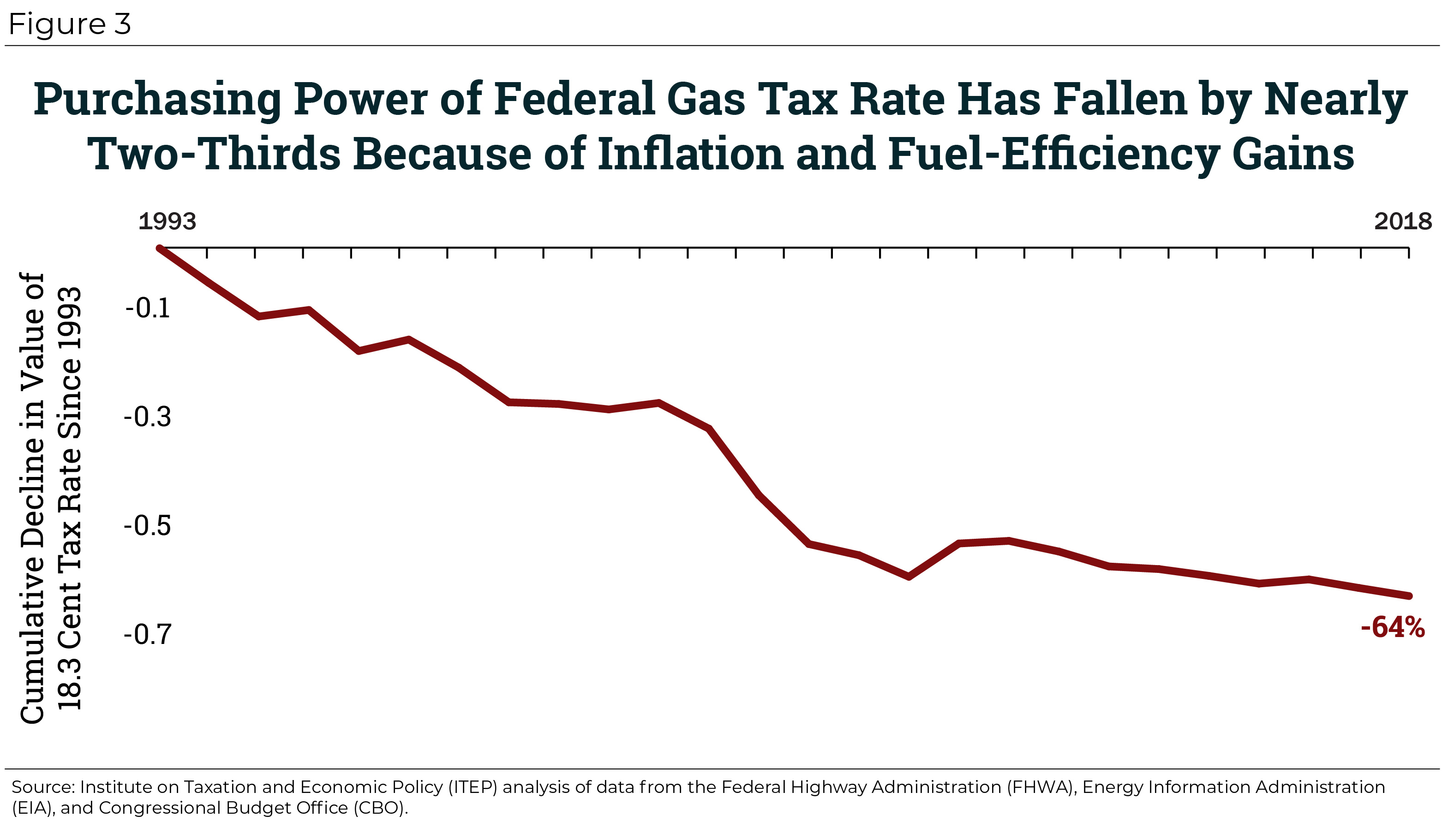

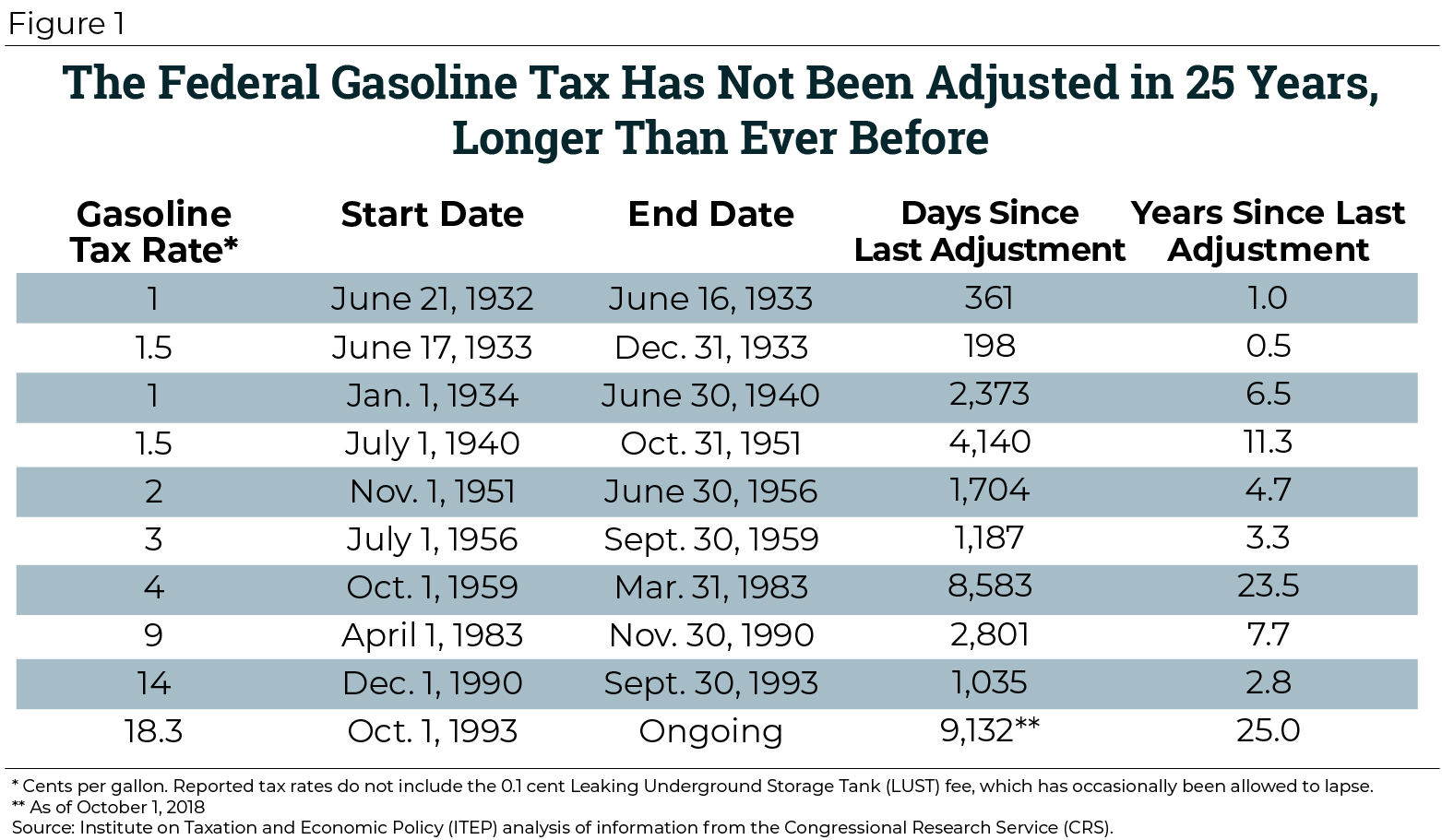

It S Been 28 Years Since We Last Raised The Gas Tax And Its Purchasing Power Has Eroded

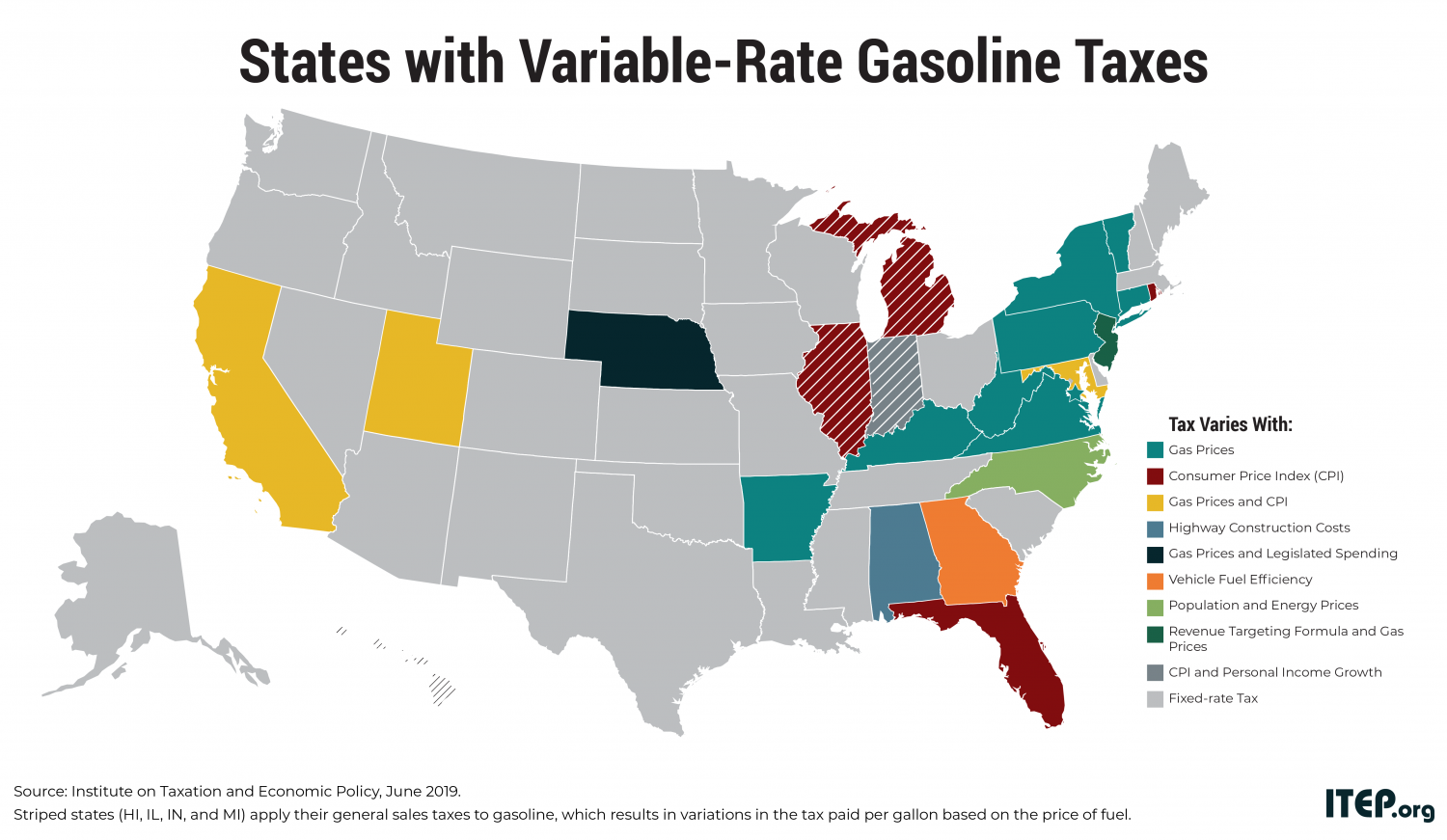

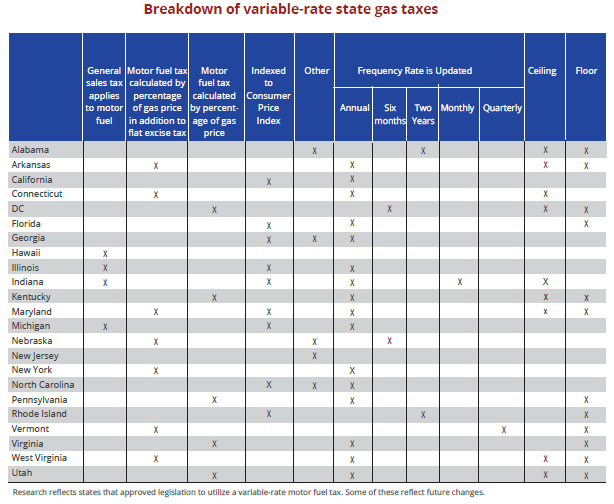

What Is The Gas Tax Rate Per Gallon In Your State Itep

An Unhappy Anniversary Federal Gas Tax Reaches 25 Years Of Stagnation Itep

Gas Tax Vs Sales Tax On Gas Will Michigan Lawmakers Suspend Taxes For Relief At Pump Mlive Com

Motor Fuel Taxes Urban Institute

Sales Tax On Grocery Items Taxjar

Most Americans Live In States With Variable Rate Gas Taxes Itep

Variable Rate State Motor Fuel Taxes Transportation Investment Advocacy Center

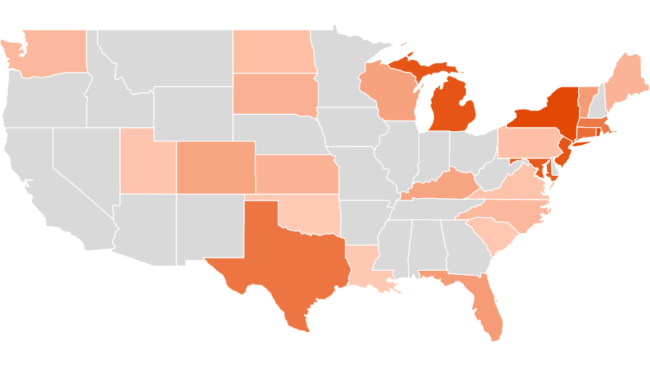

How Much Gas Tax Money States Divert Away From Roads Reason Foundation

Michigan S Gas Tax How Much Is On A Gallon Of Gas

Kansas Sales Tax Small Business Guide Truic

2022 Sales Tax Rates State Local Sales Tax By State Tax Foundation

Variable Rate State Motor Fuel Taxes Transportation Investment Advocacy Center

Gas Tax By State 2022 Current State Diesel Motor Fuel Tax Rates

Highest Gas Tax In The U S By State 2022 Statista

An Unhappy Anniversary Federal Gas Tax Reaches 25 Years Of Stagnation Itep